Owning a car is often seen as a sign that a person is succeeding in life, especially since vehicles tend to be costly. Buying a car takes a lot of money out of a person’s wallet and suddenly losing it in a road accident doesn’t sit well with new car owners.

Getting insured lets car owners stay financially secure if something happens to their vehicles as a result of collisions or theft. Uninsured car owners will lose a lot of money when caught in an accident since there are many irresponsible drivers out on the road. Car owners can protect themselves without spending too much as long as they know how to get an affordable policy.

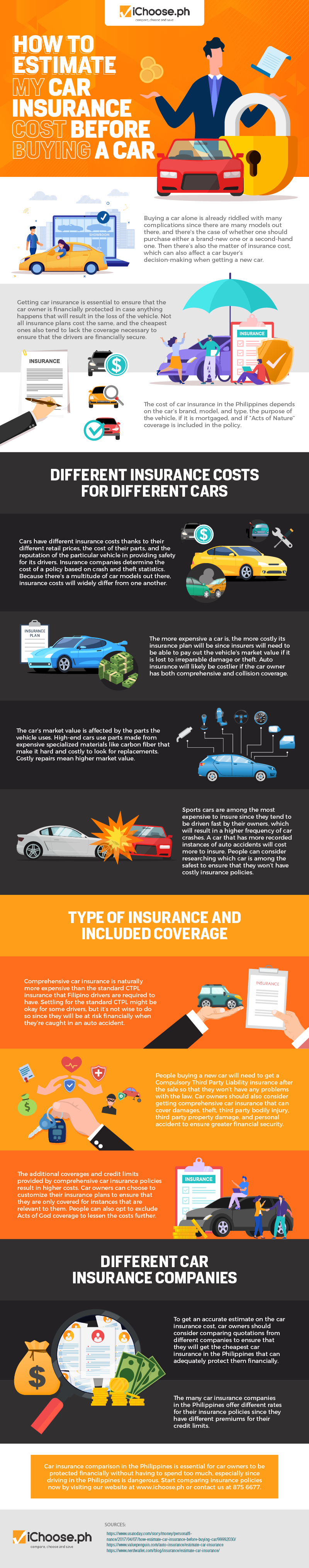

Those who’ll buy a car for the first time must remember that expensive cars lead to high insurance costs. Insurers must be able to pay for the vehicle’s market value, so the premiums that car owners will pay for are high.

People can also estimate how much they’ll pay depending on the policy’s inclusions. Comprehensive insurance plans tend to be costly since they protect car owners from a lot of instances.

Comparing car insurance policies in Alabang is also essential to ensure that the owner is sufficiently protected since different insurers offer different prices for their policies.

To know more, see this infographic by iChoose.ph.